A richer life takes more than just money

Welcome to the Indicator Warehouse blog. You can look forward to reading articles on trading education, personal development, trading psychology, relevant world business news, and even useful gadgets to make your trading life easier.

Treat Your Trading Business Seriously and You Will Reap the Rewards

There is a Psychology to taking your trading business seriously. Are you running a trading business or is it a VERY expensive hobby? I challenge you to answer this question and be HONEST with yourself. All too often I speak… Read More »

Common Trading Security Issues in Your Home Trading Office

How to Handle Common Trading Security Issues for Online Trading Software If you work out of a home office, trading security is going to be a more important issue for you than it is for most computer users. You may be… Read More »

Automated Trading Software

Man vs. Machine… Recently, I was asked if we are creating Automated Trading software for the Diversified Trading System (DTS). The answer is Yes. But it’s still far out. Why? Because while the math of this Automated Trader is based on… Read More »

Discover the Top 10 Tools for Listening to the Market

One of the toughest challenges in technical analysis trading is “listening” to the Market. Regularly we are almost convinced to recklessly foretell instead of listening. Or, we suspect we already know what’s going to occur, so we jump in and… Read More »

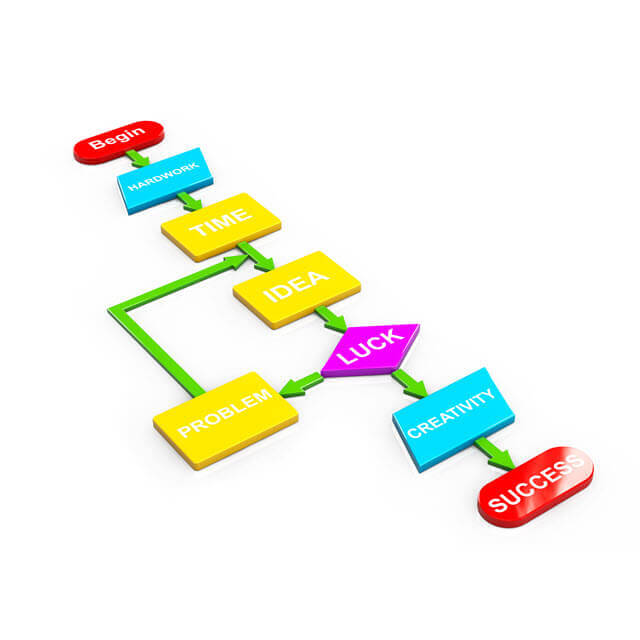

The Foundations for Day Trading Software and Education

Day Trading Software is Just One Piece of the Puzzle Finding the best method to learn to trade successfully each day regularly specialized tools and education. Unlike college, where you to were required to demonstrate what you learned via testing… Read More »

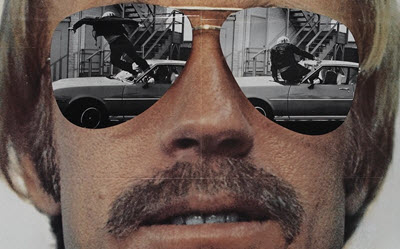

Chuck Norris’ Day Trading Boredom Smackdown

How do you deal with boredom when trading – A virtual time-bomb promising to clear out your account. Well, I do have a solution. It’s a method to cut the apathy, get All of the chart time you want, AND seriously adds to your chances of finding good trades. I have been utilizing the analogy of hunting to explain it to folk. I am not a hunter BTW nonetheless it provides a forceful illustration of what I am talking about. If you go out hunting by yourself, there’s just you and your gun. If you choose to go with your pal, now there are 2 of you and you have doubled your percentages of catching dinner. And if there are 3 hunters …

Then you increase the chances that much more.

Use Multiple Day Trading Strategies at the Same Time

Day Trading Strategies can make trading Hurricane Commodities profitable! Most traders that use day trading strategies to buy and sell commodities are unaware that they can analyze weather patterns to determine if they should enter or exit a futures contract…. Read More »

5 Ways to Sabotage Successful Day Trading

Let’s face it. Trading is TOUGH! Impossible? No. Difficult? Yes. It takes a lot of work, failure, and experience to make it. Yes, this “Shangri-La” of profitable, consistent successful day trading is attainable and reachable, but the path to get… Read More »

The Online “Free” Trading Advice Sickness

You can believe everything you read on the Internet – RIGHT? Of course, you can – it’s in print – RIGHT? Wrong! There is so much stuff out there regarding trading it’s not even funny; most of this “stuff” can… Read More »

Discover How to Overcome 5 Common Day Trading Mistakes

The ability to make rational decisions is a critical in all aspects of your life – trading and social. Once you have identified and eliminated the most common day trading mistakes, you can expect satisfaction, success and professional growth. Day… Read More »